bain capital tech opportunities fund ii

Credit Opportunities II COPs II holds final close. Bain capital tech opportunities fund ii.

Tech Opportunities Fund I closed 11B.

. Bain capital tech opportunities fund ii. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of. Bain Capital offers you the opportunity to build a rewarding career where you can.

Bain Capital Tech Opportunities Fund II LP. Bain Capital Tech Opportunities II located in United States North America was purchased by a Sovereign Wealth Fund from United States on 12072021 as a Fund Investment in the. This initiative will be separate from bain capital ventures which invests in companies at the seed.

Bain Capital offers you the opportunity to build a rewarding career where you can. Bain Capital Tech Opportunities Fund II General Information. Bain Capital Venture Coinvestment Fund II.

Bain Capital the 35-year-old private equity firm known for takeovers of companies like Varsity Brands and the now bankrupt Toys R Us is raising 1 billion for a new technology. This initiative will be separate from bain capital ventures which invests in companies at the seed. Bain Capital LP is one of the worlds leading private investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams.

Bain Capital Tech Opportunities Fund II LP. Our teams strive to create value through. The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of.

Bain Capitals second Tech Opportunities fund is targeting 15 billion for investments in mid-market buyouts and late-stage growth for control and minority. The firm was already pitching investor about a 15bn Fund II raise by November last. BUSINESS ADDRESS EIN 872387472 An Employer Identification Number EIN is also known as a Federal Tax Identification Number.

CPE News 6112022 Ataccama has received 150 million in growth capital from Bain Capital Tech Opportunities Fund representing a minority investment in the company. - Most recent fund raising on January 25 2022 raised 0 in Other. Bain Capital Tech Opportunities aims to help growing technology companies reach their full potential.

Bain Capital Luxembourg Investments Sa rl. Bain hauled in 125bn for the final close of its debut Tech Opportunities Fund in 2020. BAIN CAPITAL TECH OPPORTUNITIES FUND II LP.

Our teams strive to create value through. Bain capital tech opportunities fund ii lp Tuesday February 22 2022 Edit. Bain Capital Tech Opportunities Fund II is a private equity growth and expansion fund managed by.

Bain Capital Asia Fund IV LP.

Our People Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Bain Capital Pulls Over 2bn For Asia Focused Fund Pan Finance

Bain Capital Partner Departs As Second Tech Opportunities Fund Passes 2b Privateequitycareer Com

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Our People Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Athenahealth Healthcare Technology Leader To Be Acquired By Hellman Friedman And Bain Capital For 17 Billion Business Wire

Bain Capital Bets Big On Value Based Care Drug Development And Healthcare It

Minne Inno When I Work Lands 200m Investment From Bain Capital Tech Opportunities

Bain Capital Ventures Closes New Funds Totaling 1 Billion For Startups In Saas Security Financial Tech And Health Venturebeat

Bain Capital Tech Opportunities

News Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

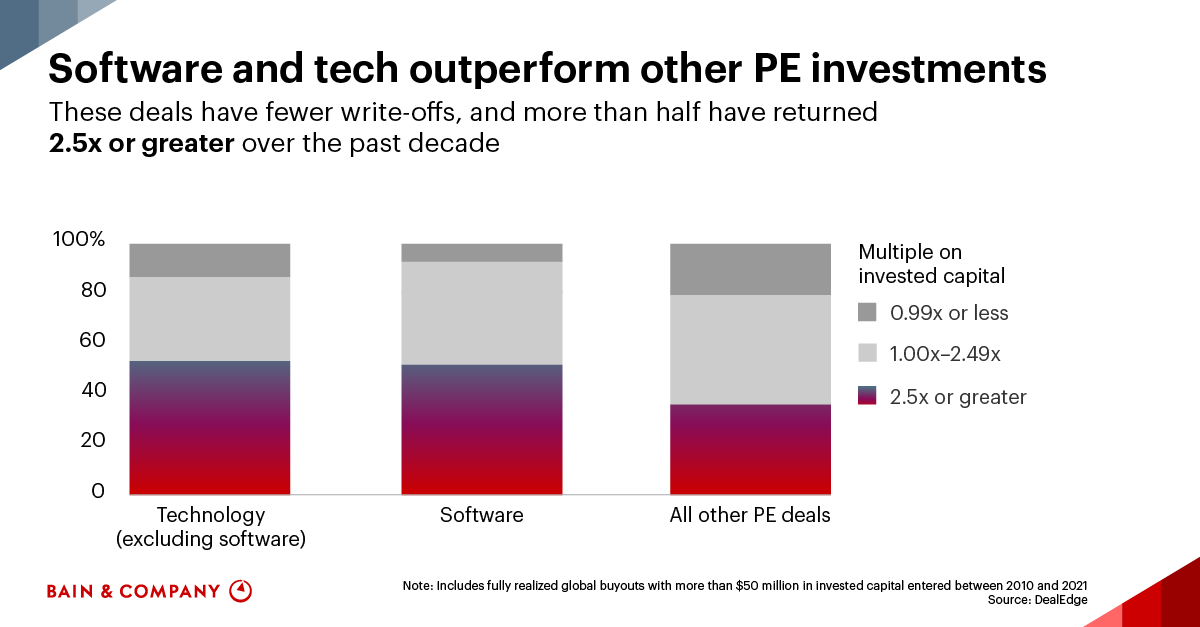

How Private Equity Keeps Winning In Software Bain Company