ebike tax credit income limit

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The amount of the credit will vary depending on the capacity of the battery used to power the car.

Tax Rebates For Ebikes In The Build Back Better Bill R Ebikes

VanMoof e-bikes displayed at the company.

:max_bytes(150000):strip_icc()/comparison-44a635d15c28423a9840966341963b2b.jpg)

. The halving of the incentive is sadly not the only revision reports Electrek. E-bikes are not just a fad for a select few. The new proposal limits the full EV tax credit for individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers down from 400000 for individual filers and.

They are a legitimate and practical form of transportation that can help reduce our carbon. Define eligibility for the program as individuals and households with incomes below the maximum. 16 September 2021 Mark Sutton.

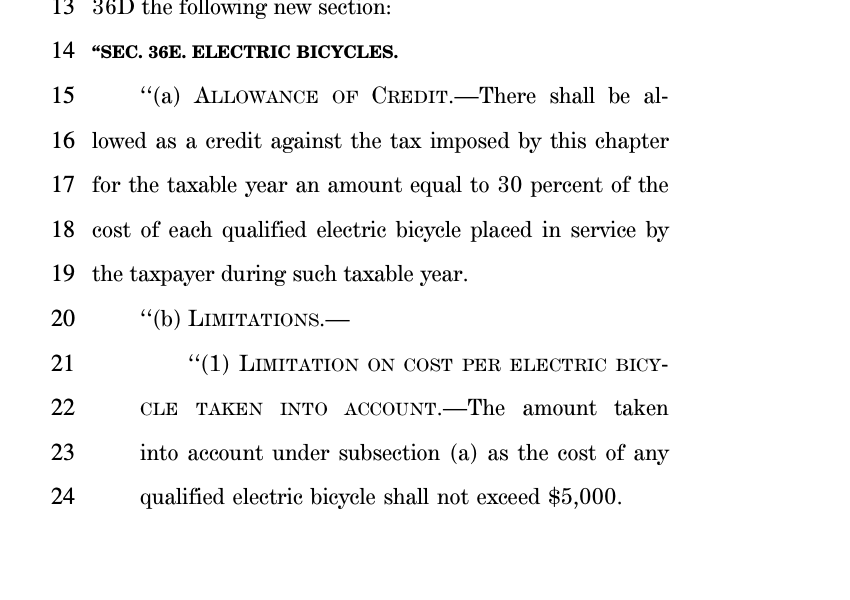

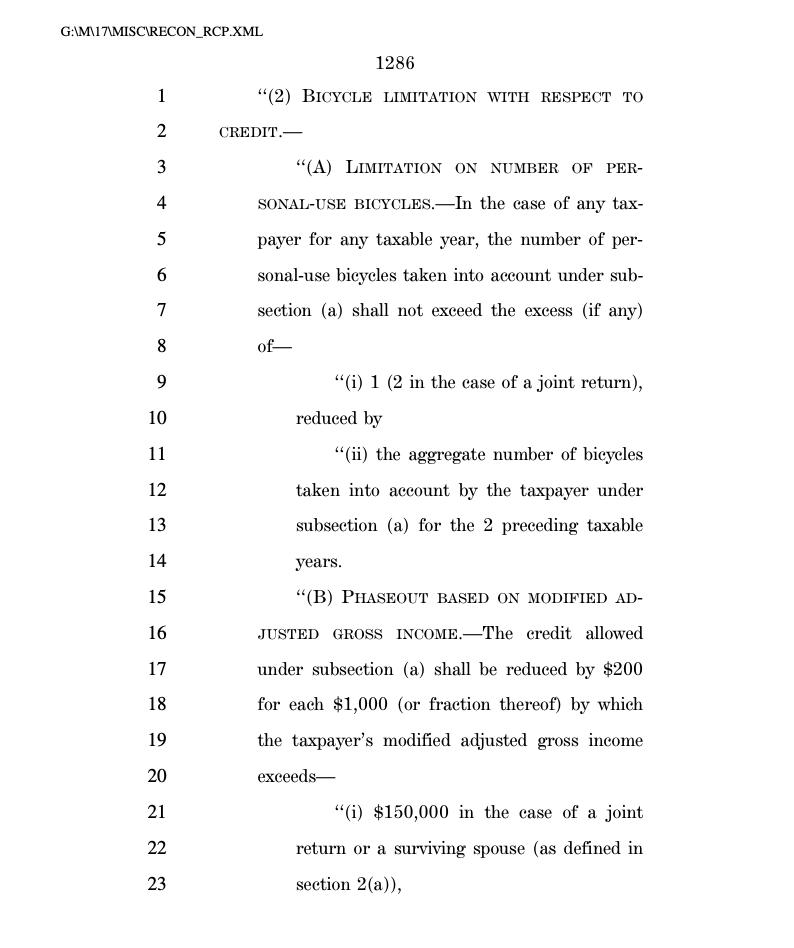

There now also exists an income based phase out of the credit applicable to those earning over 70000 or 112500 for heads of household and 150000 if the submission is made on behalf of married couples. Qualified Two-Wheeled Plug-in Electric Drive Motor Vehicle Tax Credit NOTE. The legislation would offer Americans a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500.

The credit has a limit of 1500 or 30 of the total cost whichever is less. 83k for individual or households over 158k. 30 5000 bike price limit.

Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit. Prioritize grants to individuals from low-income households. However the bill is nothing that is set in stone and is a proposed one.

The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200 per 1000 of additional. The info link you provided are from the 2009 tax credit. Help people replace car trips with e-bike trips.

It only applies to new e-bikes that cost less than 8000 and is fully refundable allowing lower-income workers to claim the credit. Supporters who have followed the E-BIKE Act since it was introduced in February will notice that these differences shrink the. For 2015-2016 this is what Ive found.

250000 for single people. The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. If you wish to splash 10000 dollars on an E-bike then you may not even need a tax deduction.

Cars need to be under 55000. Individuals may claim the credit for one electric bicycle per year max 750 credit or two bikes for joint filers max 1500 credit. The credits also phase out according to household income.

As it is currently written the bill would qualify for e-bikes up to 750W and priced up to 8000. USAs e-Bike tax credit moves along but is halved. At of 10-28-21 the tax credit plan under consideration is.

According to the federal standards the law only applies to bicycles that are 750 watts. This means that the federal government has not finalized it. E-Bike Sales Could Get Big Push From Build Back Better Act Tucked among the massive US.

Congressmen Propose 30 Percent Income Tax Credit For The Purchase Of An Electric Bike. Theres also an income limit for taxpayers to receive the credit. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each.

500000 for married couples. A proposed tax credit against the purchase of an e-Bike in the USA has made progress in Congress but those eagerly awaiting a saving of nearly a third will be left reeling at the news the discount will now be no more than 15. This incentive originally expired on December 31 2013 but was retroactively extended through December 31 2016 by HR.

Spending bill is a tax credit of up to 900 for electric bicycles. For those who make less than 75000 as an individual or 150000 as joint. The full 12500 would be earned in increments.

The E-BIKE Act creates a consumer tax credit that will cover 30 of the cost of the e-bike up to a 1500 credit. Individuals who make 75000 or less qualify for the maximum credit of up to 900. The credit begins to phase out above those income levels at a rate of 200 per 1000 of additional income.

The e-bike tax credit would phase out at 75000 adjusted gross income for individual taxpayers 112500 for heads of household and 150000 for married filing jointly. 7500 for the electric vehicle an additional 2500 for vehicles assembled within the United States and. Goals of the E-Bike Affordability Program.

The bill was created by Representatives Earl Blumenauer D-OR and Jimmy Panetta D-CA. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000.

Theyre Subject To ChangeThe value of the tax incentives is subject to change by lawmakers over time so make sure you understand what your e-bike is worth before applying for a tax incentive. Annual limits usually range from 20-30 million dollars per state for most incentives meaning not every person who applies will be approved. The proposed tax credit would not apply to any e-bike worth more than 8000.

The proposed eligibility requirements for the EV tax credit are simple.

/cdn.vox-cdn.com/uploads/chorus_image/image/68867294/1212203103.0.jpg)

E Bikes Are Expensive But This Congressman Wants To Make Them More Affordable The Verge

Biden S Compromise Legislation Platform Returns E Bike Tax Credit To Original Rate Bicycle Retailer And Industry News

E Bike Incentive Programs In North America N Eurekalert

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

/GettyImages-1139717357-20236dae817d4164bef9d05504059bc7.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

David Zipper On Twitter Update On The Federal E Bike Tax Credit Congress New Reconciliation Language Does Include The E Bike Tax Credit And It S Back Up To 30 Of The E Bike S Cost

New E Bike Act Would Offer Tax Credit For E Bike Purchases Mountain Bike Reviews Forum

E Bike Affordability Program March 2022

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

New Biden Plan Would Give E Bike Buyers Up To 1 500 In Tax Credits R Ebikes

California Capitol Watch E Bike Incentive Bill Would Help Improve Air Quality And Physical Fitness Davis Vanguard

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

Sb 400 E Bike Voucher Faqs Calbike

Electric Bikes Sparking Increased Interest Albuquerque Journal

:max_bytes(150000):strip_icc()/comparison-44a635d15c28423a9840966341963b2b.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

Sb 400 E Bike Voucher Faqs Calbike

David Zipper On Twitter Update On The Federal E Bike Tax Credit Congress New Reconciliation Language Does Include The E Bike Tax Credit And It S Back Up To 30 Of The E Bike S Cost